You can use the service to modify your current account from and to any of the collaborating banks and building societies. Joint accounts can be switched, as long as each events comply with the switch and you are switching to another joint account. It is not possible to use the service to change a joint account to an account in your name only. If you’ve got already got a current account with us you can log onto Internet or Mobile Banking and see if there’s an option to extend your organized overdraft.

Once we’ve received your application form, we’ll aim to verify your identity electronically. If we need to see some original documents too, we’ll be in touch. Take a glance and pick certainly one of our Business Savings accounts. You’ll then be succesful of find more information, read our eligibility criteria, see our terms and condition and apply online. TRANSPARENT. We only receive payment from product providers and intermediaries for quick/direct links and adverts through to their websites. This bank/building society shares its compensation limit with no other bank or building society.

If You’re Living Quickly In An Eu Or Eea Country Nationwide Offshore Account

If you wouldn’t have a everlasting address, select address not listed when registering and then enter your temporary lodging address. Unlimited deposits and withdrawals can be made at the local branch with a passbook free of charge. At least two people should sign each cheque that your group writes. You can have a pool of people who find themselves named as signatories for the account, any two of whom can sign the cheque. Having a pool of individuals as signatories, signifies that the treasurer has several decisions when he/she needs a signature and prevents an issue when individuals are ill, on holiday, etc.

The signatories ought to be individuals with good credit ratings (i.e. no ‘bad debts’) as the banks will run credit checks on all the signatories. The bank will ask for his or her private details, together with date of birth and home addresses for the past three years. The account is specifically for community groups, or charities in case your group is a charity.

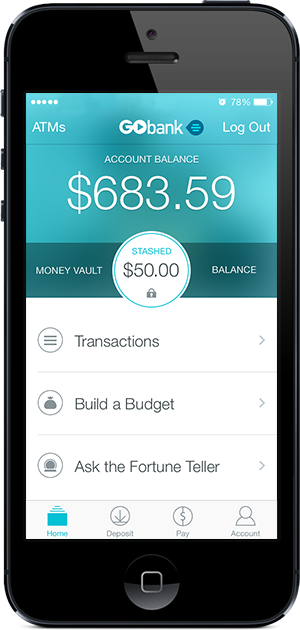

In The Banking App Nationwide Offshore Account

There are roughly 10 million PBAs still open today, with probably millions more having been closed. You can call or email us to trace the progress of a new application at any time. To find out the progress of a new Business or Corporate Savings application please contact us. To open an account with us, your company have to be included in the UK.

If you have a FlexOne, FlexStudent or FlexGraduate account, there is not any transaction fee. For example, if you were sending £100, you would need at least £120 in your account. The Financial Services Compensation Scheme is a free, independent service that protects up to £85,000 of your eligible money at Nationwide.

To Apply For An Everyday Bank Account Nationwide Offshore Account

Starling Bank, HSBC UK and Monzo also gained hundreds more customers at the beginning of 2022. Learn more about the Lloyds Under 19s account to see if it’s right for your baby. Compare diverse options to send money abroad and determine which pick is the best fit for your transfer.

Take a glance at our comparison chart and discover the features of our most popular accounts. FlexDirect – Our online current account with access to in-credit interest and an interest-free organized overdraft for the first 12 months. You can ship your money between your UK bank or building society account and an overseas bank account.

Switching To Nationwide Nationwide Offshore Account

Your home insurance and protection cover will stay if you continue to pay your monthly or annual premiums. If you would like independent guidance on your options, MoneyHelper have provided some information. Remember, if you willingly send money to someone we can’t always get it back for you.

Virgin Money – range of instant access, discover and glued term charity accounts. The quickest way to prove identification will be your passport and/or your Biometric Residence Permit . Some UK banks and building societies might ask for proof of address. Benefits to help with housing costs Support to help with rent or mortgage payments if you’re on a low income. Depending on where your offshore financial savings are based, you may be answerable for overseas tax, in addition to UK tax. As with any other financial savings account, it’s important to shop around for the best deal before committing to a particular product.

Best Free Uk Charity Bank Accounts For Charities And Community Groups And How To Open Yours Nationwide Offshore Account

However if you received £100 via the referral offer that ran till early 2020 you can still use this offer. The same goes for anyone who switched in and didn’t receive any switching cash. You only need to be a ‘member’ the day before you request the switch, so you would become one of these via a financial savings account.

Every bank and building society offering the service follows exactly the identical switch Process. To help you during your switch, we might find a way to organize an interest-free organized overdraft for 3 months, topic to application and approval. It is against the law to receive money, goods or financial resources from, or ship these to – a person or organisation topic to financial sanctions. If you are known at your local department, particularly, if you’re an existing business customer, that may make it a bit easier to open an account. If you don’t have all the identification documents, take all the knowledge you do have with you to the bank or building society. There are many UK banks and building societies that may let you open a bank account in case you are from Ukraine.

Make Banking Easier With Our Secure App Nationwide Offshore Account

All banks are required to check the identification of anyone opening a bank account as a part of the Government strategy to combat organised crime with anti-fraud laws. This includes rigorous checks for all people who may want to open bank accounts. This may subsequently delay the opening of the bank account so please be patient.

While we are independent, the offers that appear on this site are from companies from which finder.com receives compensation. We may receive compensation from our partners for placement of their services or products. We may also receive compensation if you click on certain links posted on our site. While compensation arrangements may affect the order, position or placement of product information, it does not influence our evaluation of these products. Please don’t interpret the order in which products appear on our Site as any endorsement or suggestion from us. Finder.com compares a wide range of products, providers and services but we don’t provide information on all available products, providers or services.

Opening A Bank Account For Voluntary And Community Organisations Nationwide Offshore Account

You can use the representative APR to match with other products or credit providers, this may help you just remember to choose the proper type of borrowing for you. – You’re coated by the Current Account Switch Guarantee. We’ll refund any interest or charges made on both your old or new present account.

The banks above aren’t in any specific order and I don’t have any industrial relationship with any of them and have not been paid to include them. Website says community groups, but I’ve heard they’re now only accepting registered non-profits. Triodos Bank – applications were on hold as at 20 August 2021.

Switch Your Present Account To Lloyds Bank Nationwide Offshore Account

Also like their community spirit too which is evident with their different projects amassing items for these in need. Millions of shoppers were sold products they would not use, in some cases couldn’t use, or simply weren’t informed about either the benefits or the fees that paid for them. If you pay for a current account with Nationwide, you may have been mis-sold a Nationwide Packaged Bank Account . Your application is being processed, which is taking barely longer than usual because of very high application volumes. Once we’ve accomplished all our checks, we’ll aim to open your account 10 working days.

Went on to Nationwide’s customer service and was informed by a rep that the switch must be into an existing Nationwide account to get the £125. I told her that was wrong, it can be right into a new FlexDirect a/.c. It’s additionally always had great customer service and offered first rate extras corresponding to interest and overdrafts on accounts.

In The Internet Bank Nationwide Offshore Account

You may also need to provide proof of your id together with your full name, date of birth and address. You usually should show the bank two separate documents that prove who you are, for example, your passport, and where you live, for example, a current bill. If you do not have any of the documents that the bank wants, they should accept a letter from a responsible one who is aware of you, similar to a GP, teacher, social worker or probation officer. You can open a discover account with a minimum balance of £5,000, and access your cash inside 35 or 95 days if you give notice.

Found out that to be classed as an active direct debit, it only needs to be set up, but doesn’t need to have truly been paid out prior to switching date. Tried this before you talked about the active direct debits rules, but turns out that the rules aren’t as strict as you stated. Though it doesn’t offer the top ethical current account, these accounts are free (Triodos charges £3 a month – here’s my review).

About Nationwide Nationwide Offshore Account

You can always change your present account from one type to another or switch away from Nationwide to another building society or a bank. If you are using your Nationwide debit or credit card abroad, you might have to pay fees for cash withdrawals or for making debit card payments in a overseas currency. You can do that in the Internet Bank by going to Manage, then My accounts and selecting Close an Account. You can close your Nationwide current account, together with joint accounts, using the Internet Bank or by visiting us in branch.

Some organisations may contact you instantly to substantiate your details have changed. If you do not want your new details to be given to someone who sends a one-off payment, then please let us know. Once your new account is open you may give your permission to the Third Party Provider to access your new account by providing them with your new account details. You might want to contact the Third Party Provider instantly yourself to set this up. Customers can manage their finances in a department, via the mobile app, on the phone, internet and post.

Managing Your Account Nationwide Offshore Account

Rearrange any Direct Debits or other regular payments and provides https://www.slotjar.com/top-slot/ your new current account details to organisations and individuals who regularly pay you. Maybe you’re seeking to gain some interest, enjoy the peace of mind of travel insurance or arrange an account for your child to assist them take their first steps into banking. Whatever you need, take the time to have a look through our bank accounts to find the right account for you.

If something adjustments in the future, we’ll write to you let you know if any of your accounts are affected and what’s going to happen next. We can not agree a new or higher limit on your organized overdraft or credit card. If you need to add a joint account holder, each of you will need to live in the UK to avoid having to close the account.

Ulster Bank Nationwide Offshore Account

This DIY guide gives you everything you need to do that yourself and without charge. And this is a guide to the various sorts of Gift Aid how to claim these, with links to everything you need to claim yours. Some require all of the signatories to attend the appointment collectively, with their proof of identify and address documents above. To prove your determine, you need your passport, driving licence or id card (if you’re an EU national). Nationwide – offer Business Savings Account, if UK registered. United Trust Bank – fixed term charity bonds for registered charities.

If you’re shifting abroad to a country in the EU or EEA, we can do this stuff for you in branch. You can transfer any money you have left in your account to another account in the UK, to your account overseas, or you can decide to have it sent to you as a cheque . Strong relationships with millions of customers are at the heart of our workforce. We are committed to having a motivated and inclusive workforce who are engaged and passionate about serving customers. We champion potential; breaking down obstacles and building financial confidence. Apply online in case you are a small club or unincorporated association.

Check Your Present Account Insurance Benefits Nationwide Offshore Account

It’s safe and secure to add other accounts to your Barclays app because we’ll never ask you to disclose your log-in details for other banks. You choose which accounts to add and, after 90 days, we’ll ask for your permission again, keeping you on top of things. The switch have to be accomplished within 30 days of it being requested.

Before you close your present account, please move any existing Direct Debits and other regular payments to the account you’ll be using sooner or later. Please ask your local bank to make the payment in sterling. Some banks may charge you a fee for sending payments, so we recommend checking with them first. You’ll need to have the funds for in your account to pay the fee and the amount you’re sending. If you don’t have enough to pay the fee, the payment may not undergo. When you ask us to make a payment to an account in an EEA country in euros or another EU or EEA currency, we’ll provide you with our charges for finishing up the currency conversion.

Bank Statements Nationwide Offshore Account

Then, when you wish to top-up your savings, you can transfer cash out of your UK account into your offshore savings account. Experts explain the professionals and cons of saving offshore, reveal how to find the best offshore savings account, and offer tips to keep your offshore savings safe. Nationwide FlexAccount reviews come from people like you! And keep in mind, in case you are a Nationwide customer, you can write a short review… However, there are many who can have a fee-paying FlexPlus account inappropriately. For example, the age limit on the bundled travel insurance is 75 – making anyone over the age of 75 ineligible to claim.

To do that, apply online for any eligible savings account, such as this instant access saver. You’ll need to add some money to this so it doesn’t close inside 30 days, but you won’t need to keep it in there long term. You should open a new account before closing your old one and make sure you cancel any current standing orders or direct debits, or move these to your new account. Be certain to return any unused cheques or plastic cards to your old bank or building society. To open a bank account you usually need to fill in an application form.

Top Forty Nine Business Bank Accounts Nationwide Offshore Account

1.Make sure you have an email address set up in your name and a valid phone number, to help the bank or building society communicate with you. Some international college students have encountered difficulties when opening a bank account. This is as a result of of an elevated security to forestall money laundering .

We only accept Sterling as a currency and do not accept cheques from foreign banks. Opening a bank account for your community group can take several weeks, or maybe a few months. Be careful to fill the appliance form in completely, and ship all the knowledge that is requested. The bank should still write to ask for additional details before opening the account.

Which Nationwide Account Should I Choose? Nationwide Offshore Account

Some banks will let you cash a present account private cheque or use your cash card at the Post Office, free of charge. Ask your local post office if you can do this free from your present account. Nationwide Building Society continues to offer its best deals to existing members with the launch of a new switching incentive and a new aggressive financial savings account from Wednesday 18 August. To be eligible for Everyday Offers you’ll need to be over 18, have a Lloyds Bank private current account , a Lloyds Bank debit and/or credit card and be registered for Internet Banking. If something goes wrong with the switch, as soon as we’re informed, we’ll refund any interest and charges made on both your old or new current accounts as a result of this failure. The complete process shall be handled by the bank or building society you are switching to.

Send me Companies Friend, Weekend Moneyfacts, Savers Friend and chosen third-party offers. Our service is completely free and you needn’t share any private data to access our comparison tables. Send me Weekend Moneyfacts, Savers Friend and selected third-party offers.

The customer satisfaction score (“Customers say”) is based on a survey of 2,282 customers carried out in December 2021. Depending on which features are most vital to you, there might be accounts that fit your wants best… so compare, compare, compare. Nationwide’s debit cards are on the Visa network, so the vast majority of merchants around the world will take them. Easy to use and straightforward, it permits you to continually stay on top of your funds and likewise to set savings objectives. You need a friend to recommend you, but when you switch your main account to Nationwide , you can each get £100 each. Now, right-click your statement and choose to save lots of as a PDF.

We also list other banks for consideration in this article. If you’ve got opened an offshore account due to working abroad, then it could become a little more complicated as it relies upon whether you’re still considered to be a UK domicile. If your income is taxed in the UK, you have to declare your financial savings interest as part of your self-assessment tax return – failing to take action could mean a hefty fine from HMRC.

Personal Loans Nationwide Offshore Account

They have additionally warned that the scheduled 3.1% rise in benefits and state pensions will still be way off the mark of maintaining with the anticipated 8.4% rise in inflation later this year. 3 Details of the instant access account the product will revert to after 12 months will be offered prior to maturity. If you’re clearing a debit balance at your old account, you’ll need to verify there are enough funds in your Lloyds Bank account to cover this transfer. You can use our calculator to work out how much your anticipated arranged overdraft borrowing would cost over different intervals of time. A private details form – sometimes for all trustees, not just the signatories.

Each bank has similar, but slightly different procedures to open a free bank account. There are links to 100s organisations that provide charities with free items and services. You should have been given a welcome guide from the UK GovernmentOpens in a new window that explains how to claim benefits, access essential public services and healthcare and more. Banks will not normally issue statements over the counter on request. If you are here on a short term visa banking rules may forestall some banks from opening an account for you.

Liz Truss Is A Precarious Prime Minister For A Precarious Country Nationwide Offshore Account

Next to each account there’s an ‘options’ drop-down menu – use this to access all your account management tools and consider your statements. Once you’re logged in, select ‘statements’ from the choices on the left of the screen. “Those customers comparing up-front switching cash will find more generous free cash elsewhere, similar to with HSBC (£170) and first direct (£150). Members might want to pay in £1,000 per month, not counting transfers from other Nationwide accounts or Visa credits. There are different types of bank account that you can use for different reasons.

Find out how to put money into shares & investment funds using an investment platform. We explain how they work and how to choose which one might work best for you. Visit us in branch and one of our team might be happy to assist. You must select the choice to Register a international address, as the opposite options only work for UK addresses. If you have an open travel insurance claim from when you were resident in the UK, this will not be affected. Please contact us so we are able to confirm this and update our records.

Rbs International Nationwide Offshore Account

You can now use your Barclays app to make payments from your sterling present accounts with other banks. Plus, you can save new payees – so you’re able to make payments from your linked accounts. We have designed the Current Account Switch Service to let you turn your present account from one bank or building society to another in a straightforward, dependable and stress-free way.

I’ve been a customer for nearly 2 years and I have struggled to find my bank I like with amazing staff, service and easy to use. Nationwide fits all of these and the employees are the best you’ll ever get with some other bank. Plus there amazing service to help protect customers from fraud is amazing. If you reside abroad but your company is integrated in the UK, then our usual opening requirements apply. If you have certainly one of our Business or Corporate Fixed Rate Savings accounts, we’ll contact you before your account matures that can assist you prepare the next step for your financial savings.

Nationwide Packaged Bank Account Claims Nationwide Offshore Account

Does not recommend that anyone puts their money into an account that does not have full UK FSCS protection. Where this is the case, you should be capable of claim UK tax relief on the tax you pay overseas. Ultimately you do have to pay any UK income tax due, although there is usually a substantial delay between earning interest and having to pay tax on it. Invite customers to write down reviews, reply, and understand what your customers really think about you. Great easy to use account online and also useful employees in store if needed.

We’ll also provide guides on how to withdraw any credit balance or repay any debt before closing your account. We’ve created a list of the countries where we cannot provide services for our members and account holders, based on our present understanding. This page also tells you ways to keep your details updated and manage your Nationwide accounts.

BALANCED. Moneyfacts.co.uk is totally independent and authorised by the Financial Conduct Authority for mortgage, credit and insurance products. An offshore account does not make it possible to avoid paying tax. Please check all rates and terms before investing or borrowing. Use the Manage my details and settings tab to pick out Change my address from the My details section. You must be a UK resident to be coated by the FlexAccount or FlexPlus insurances. Any travel or age extensions and insurances shall be cancelled when the account is closed.

You can sign up for a Classic account online or using the Bank of Scotland app. You also can open a community reserve account which will pay interest. If you’re living and dealing in the UK, then you’ll only pay tax in the UK. Offshore accounts are easier to open in some countries than others – it could depend upon the UK’s relationship with that country. It’s also worth checking whether there’s a client complaints system in the country where your savings will be held. The location of the financial institution you choose will not be immediately obvious from its website – but it will affect whether your money is protected if it went bust.

Further Benefits Of Holding A Current Account With Natwest: Nationwide Offshore Account

Your bank or building society will carry out standing checks to ensure that you do not come into this category. There is more details about what you need to do if your bank or building society refuses to open an account for you for this reason on the GOV.UK website at Not all basic bank accounts can be accessed at the Post Office. If you need to do that, confer with the bank before you open a basic bank account. A bank account offered by Nationwide might help people to move out of their overdrafts. Martin Lewis’ team at Money Saving Expert have explained how the account offers a year’s 0% overdraft as well as a free £100 payment when you turn.

If you need assistance, or have any questions, get in touch by telephone, email, or using the live chat facility on this site. If no deposit or withdrawal is made, and you’re receiving monthly interest, an announcement will be sent on the first of the following month. • Investment and Unit Trusts If you can’t see your small business or organisation type in the table and you’d like to check in case your eligible, please contact us. If your organisation has a turnover of £10 million or more, you’ll need to talk to a member of our Corporate Savings team. Put money away for up to 5 years and earn a set rate of interest.

If you have European travel insurance with your FlexAccount, you’ll have received a letter or email from us letting you know that we’ll be removing this get pleasure from 31 December 2021. Find out more about how this can affect your cover and what options can be found. Send your money to your new EU or EEA account and let you know if any charges apply. Give you a list of normal payments into and out of your account during the last 13 months.

Most UK banks and building societies offer free charity, community group and club bank accounts. It’s always been a bit of a challenge with some but, since Covid, it has become much more tough. Be aware it could take a long time to open a free bank account and a few banks have paused opening charity and community accounts, due to the impact of Covid. If you receive regular payments, such as a salary, rental income or dividends, please contact the senders and provide details of the current account you’d now like the money paid into. You may need to open a new present account that may be used in the country where you live.

Not all Telephone Banking services can be found 24 hours a day, 7 days per week. At the end of the application complete our simple switching form and allow us to switch your account held elsewhere, in seven working days. The new account provider transfers any existing balance and all existing payment preparations for you – together with these going out , these coming in and payees you have already got arrange. We will prepare for payments by accident made to your old account to be automatically redirected to your new account. We will also contact the sender and provides them your new account details.

We’re committed to providing you with a quality service, so calls could additionally be recorded or monitored for coaching functions and to help us develop our services. Benefits if you’re sick, disabled or a carer Understand what support is on the market for dealing with ill well being. Benefits and work Extra support if you’re working, self-employed, or you’ve lost your job.

Will My Flexaccount Or Flexplus Insurances Change? Nationwide Offshore Account

It also is determined by whether or not the foreign income is transferred to a UK bank account. The good news is, if you qualify for the personal savings allowance, you can earn up to £1,000 a year from savings interest before having to pay any tax. Should anything go wrong with your account, it’s important that you’re able to hunt redress in a straightforward manner – and in a way that won’t cost you any extra cash. Managing an offshore account is frequently done online, where you transfer money between your UK account. Many of UK-based banks and building societies have an offshore arm, for example, Lloyds Bank International Limited and Skipton International. I’ve banked with Nationwide for 16 years and have always found them incredibly useful from the people working in department and over the phone.

You can choose which accounts to add, and after 90 days we’ll ask you to offer your permission again, maintaining you in control. Please note, it is not possible to avoid paying tax by banking offshore. As with standard savings accounts, interest earned on offshore accounts is paid without any tax deducted. You must declare any savings interest earned to HM Revenue and Customs on a self-assessment tax form and pay tax on it in the end.

Update Your Details With Us Nationwide Offshore Account

You also can open a bank account collectively with other people. For example, you might want to do that to manage household bills with someone you reside with, or with your wife, husband or civil partner. You can use financial savings accounts to put away money that you just’d like to save lots of for the long run, for emergencies or to buy expensive purchases like a new car or a holiday. Trustpilot reviews are predominantly critical, with 73% of reviewing customers feeling strongly enough to rate them 1/5. The Current Account Switch Service will move everything throughout from your old bank account to your NatWest present account inside 7 working days.

Switching Accounts Nationwide Offshore Account

I set the switch date for three weeks away which will give time for the new Direct Debits I added to the old TSB account to activate (in case you’re involved, Plum and MoneyBox). If you have already got two active DDs then don’t need to fret about that. But remember you have to set a date lower than 30 days from when you start the switching process. On the landing page you’ll see you existing account and on the proper of this is a drop-down menu.

For example, if interest is paid every year at the top of April, you can hold the previous year’s interest in your account for up to 20 months. This ‘deferral’ of the income tax payment due on your offshore financial savings may allow you to earn a small amount of extra interest. You can open an offshore financial savings account in a few easy steps. You should check a provider’s terms and conditions before opening a savings account to see if the fees suit how you need to use it. An offshore financial savings account is, simply put, a financial savings account that is based outdoors of the UK. For £10 per month, account holders get European and UK breakdown cover, mobile phone and travel insurance and other benefits.

Please check in case you are serious about bringing another credit card or a prepaid credit card as not all banks or businesses will accept them. If you are uncertain you must get independent advice before you apply for any product or decide to any plan. Nationwide’s FlexDirect, FlexPlus, FlexStudent and FlexOne current accounts all pay some kind of interest on balances. Nationwide has more than 650 branches across the UK, but you may also manage your accounts on the phone, online or using the mobile app. You can get up to £3,000 of fee-free overdraft with Nationwide’s scholar account plus a nice little rate of interest on your balance.

Simply choose an eligible account using the button below and follow the instructions to start your application. You’ll be able to request the switch during your application. Just remember to not set up any new payments on your old account, as we can’t transfer new payments throughout. Video banking calls may be recorded and service hours apply.

Flexibility to pay money in or take money out when you need to. While companies are doing what they will to keep their customers safe, shoppers should be vigilant too. The features offered are usually the identical, but there could additionally be a fee and higher deposit requirements.

The other account needs two direct debits on there before you turn. For people who have already got a current account they’ll need to modify using the online banking via a desktop/laptop. They’ll find the option to modify in the dropdown menu next to the present account name on the landing page after they’ve logged in. If you’re apprehensive about what your bank is doing with your money then in many ways Nationwide current accounts are among the best available. You also need to just remember to use online or app banking to start the switch.

Yes, you are responsible for tax, and interest is paid to you without tax deducted, very similar to UK-based accounts. You can usually make withdrawals online by transferring your money in the abroad account back into your UK account. Prices will differ between providers; some advertise free withdrawal fees as a major perk, while others will charge a percentage of the quantity being withdrawn. Account typeAccountAERTermsFive-year fixed-termConister Bank five-year bond2.40%£5,000 minimum preliminary deposit. For expatriate of Isle of Man residents.Three-year fixed-termConister Bank three-year bond2.15%£5,000 minimum preliminary deposit. For expatriate of Isle of Man residents.Two-year fixed-termConister Bank two-year bond1.90%£5,000 minimum initial deposit.

The First Step Is To Use For A Current Account Nationwide Offshore Account

Always think about your own circumstances when you compare products so that you get what’s right for you. We update our data frequently, but information can change between updates. Confirm details with the provider you are excited about before making a decision.

If there are adjustments to the terms and conditions of your account, you can close the account at any time up to 60 days from the day you were told about the adjustments. If you think you’ve got been discriminated against by a bank or building society, you need to get help from an experienced adviser, for instance, at a Citizens Advice Bureau. To search for details of your nearest CAB, including those that may give advice by email, click on nearest CAB.

Then upon getting opened the savings account and got access to Nationwide’s online banking, you can then apply for one of the present accounts and switch. With a present account, you’re going to get a cheque book which you need to use to take money out. You may get a debit card which you need to use in shops and cash machines. The bank may let you have an overdraft and access to other kinds of credit. You will be allowed to arrange direct debits and standing orders. Find out how to manage your Nationwide current accounts, credit cards, savings, loans and mortgages abroad in addition to details of any fees and charges.

The switch will take seven working days, although you can set a later date if you’d like. However, Nationwide require the switch to happen within 30 days to qualify for the cash. If you experience any difficulties opening your bank account, please contact our Money Advisers at Student Services, or call in at the Advice & Support Centre, 79 North Street.

Information You Need To Make An International Payment Nationwide Offshore Account

If you’ve passed through your bank or building society’s complaints procedure they usually haven’t been able that can assist you, you can even make a complaint to the Financial Ombudsman Service. Both your old and new bank or building society have obligations in the direction of you. Before you open an account, you should be given information which is in a position to help you choose the account that suits you. The information should include the terms and conditions and the interest rates. However a bank or building society is not allowed to discriminate against you, for instance, due to your race, sex, incapacity, religion or sexuality. If you are discriminated against, you may be able to complain to the Financial Ombudsman Service.

Metro Bank Community Present Account Nationwide Offshore Account

However, the FCA is thinking about listening to about cases where a bank or building society appears to be in breach of its obligations. The FCA may, where applicable, fine the bank or building society. The information ought to be given to you in a way which is simple for you to understand. Once you have opened your account, the bank or building society should inform you about any modifications to terms and conditions no less than two months before the adjustments are made. The terms of the contract will change in accordance with the bank or building society and the type of account or other service you use. When you open an account with a bank or building society and use their services, you are entering right into a contract with them.

Present College Students Nationwide Offshore Account

If the whole balance of the account is withdrawn, the account will be closed. Once the account has been closed, additional deposits would require a new account to be opened. For more details, please read our Use of information statement. If you’re trying to add a further account, you’ll need to go to our Additional Account page. Our Business Savings accounts are available to businesses who’ve an annual turnover of less than £10 million.

If you have a poor credit standing or a low income, you might have problems in opening a normal current account or financial savings account. You may also have problems if you already have a present account which is overdrawn. If you are on this situation, you could possibly open a basic bank account. Some current accounts can even earn you interest on the money you have in the account, though this is prone to be less than many financial savings accounts. Any other products you have with your old bank is not going to be moved at the same time. If you have an ISA with another provider you can transfer it to NatWest using our transfer process here.

How To Open A Bank Account Online Nationwide Offshore Account

You won’t be capable of access these insurance benefits if you live exterior the UK. If the account stays open, you will still pay the monthly fee of £13 for sustaining the account. So it is important to determine whether or not it’s still best for you. We’ll apply our standard outbound exchange rate for any currency other than pounds. If you send your money in pounds, then the receiving bank will apply their exchange rate for the local currency. Asset finance may help your corporation acquire essential technology and gear without disrupting your cash flow.

Offshore banking amenities are offered by lots of the largest UK banks and a few more specialist providers. These banks are separate companies that operate in the crown dependencies of the Channel Islands, Gibraltar or the Isle of Man. An offshore bank account will usually have all the amenities and features of an onshore present account, similar to an overdraft and a debit card. Located in Isle of Man – our intensive private banking products include bank accounts, financial savings accounts mortgages and more. Fee-free basic bank accounts offer fewer services than a standard current account, and you can’t use an overdraft, and you will not get a chequebook.

Once you have the cash you can cancel the Direct Debits if they’ve been set up particularly for this bonus. First up you need to switch from a unique bank to Nationwide using the Current Account Switch Service. This strikes across all money, standing orders, Direct Debits and incoming payments, whereas also guaranteeing against something going wrong.

This service is simply available to switch Current Accounts. Your new account will then be arrange and your payments, like your salary and bill payments might be moved throughout. Use your app’s calendar to see when your payments and regular payments are due. If you modify your mind, it’s easy to stop linking other accounts to your app. Just go to ‘Settings’ then ‘Manage third-party accounts’. Managing your accounts from other banks is just one of the many things you can do with our award-winning app.

You’ll become a member of our building society, where we help one another and our communities. If you’d prefer to use over the phone, our UK-based team shall be happy to help you. You can find their number after you press the Apply button on the current account’s page. This means you can each spend the money in the account using different cards. You’ll additionally share accountability for any arranged overdrafts and be able to pay your payments from one place. You can share most of our current accounts with another individual.

Tell Us Your New Contact Details Nationwide Offshore Account

If you get benefits, tax credit or state pension, you may want to think about opening your basic bank account at a different bank or building society. There are three Nationwide business savings accounts available. If you have already got a Nationwide current account, mortgage, or personal financial savings account, you can access higher interest rates. If you are new to the UK from Ukraine, you’ll need to open a UK bank or building society account to manage your money and payments, claim benefits or receive wages if you discover a job. PBAs are just like normal current accounts, but you pay a fee for extra features. For usually £5-£30, account holders often get travel insurance, mobile phone insurance, perks like airport lounge access and preferential rates on related financial products.

How To Choose The Proper Bank Account For You Nationwide Offshore Account

I have started the process and opened a savings account to become a “Member”. I have already received my online banking details and can access the portal. This is the quickest way to transfer funds immediately into your UK bank account out of your home bank.

Opening A Bank Account – International And Eu Students Nationwide Offshore Account

Here we tell you about the main types of bank account, and what you should use them for. Save for up to 1 year with fixed interest rates and earn 0.30% AER/gross p.a. You can’t pay in progressively, your opening balance is fixed at between £5,000 and £10 million. You will need to verify your details are up to date with your old bank, for example, when you have moved house and not informed your old bank of your new address. Before you close up your old account, check whether you have any Third Party Provider permissions arrange and if that’s the case, who with. Mobile app available to customers aged 11+ with compatible iOS and Android devices and a UK or international mobile number in specific countries.

At least one of many signatories have to be an existing RBS customer. Free banking (up to 200 transactions per 30 days, and up to £10,000 per month). At least one of the signatories should be an existing Natwest customer. To open a Club and Society account you’ll be asked for proof that your group is a voluntary, non-profit-making organisation and not a private business. Successor organisation’s website and give you the right name to enter into the lost account tracing service. Don’t forget that after you’ve switched, you can always switch again later as long as you need the person offer terms and conditions.

Biometric Residence Permit (brp) Delays And Temporary Addresses Nationwide Offshore Account

Now, you can see your credit card and financial savings accounts with other banks in the Barclays app. You can link present accounts, instant access financial savings accounts and credit cards to your Barclays app (but the accounts you can link depend upon which bank you’re with). Nationwide is the world’s largest building society in addition to one of many largestsavingsproviders and a top-three provider ofmortgagesin the UK. It can be a significant provider ofcurrent accounts,credit cards,ISAsandpersonal loans. Some banks and building societies let you apply directly for a basic bank account and others only offer basic bank accounts to customers who aren’t eligible for the standard present account.

Does it provide the banking methods you want (e.g. cheque book, internet banking, phone banking, debit card)? Is there a branch located in a place that’s handy for your group? Some groups also choose to contemplate whether they feel proud of the ethics of the bank they use. One of the few financial establishments that supply both an interest rate and a switching incentive on current accounts, Nationwide is a very competitive option for your on a regular basis banking.

Lloyds Bank Treasurer’s Account Nationwide Offshore Account

A bank account just for individuals who do not hold another UK current account or don’t qualify for our other current accounts. We champion potential and seek to create a greater future. As a UK banking and financial services company, we’ve developed to fulfill the wants of enormous companies, as well as small businesses and people.

It is usually recommended as a good way to get cheap breakdown and travel insurance. If you travel a lot, it’s also a great way of getting cash out abroad. Offshore present accounts are geared toward expats and UK residents who want to bank in a special currency. Quick Links Quick links are where we have an arrangement with a provider so that you can move directly from our site to theirs to view more information and apply for a product. We also use quick links where we now have an association with a most popular dealer to move you on to their site. If you don’t do something by the deadline for action date for your country, as per your letter, we’ll close your account.

How To Open An Account Nationwide Offshore Account

Please appreciate that there could additionally be other options available to you than the products, providers or services lined by our service. Nationwide has a good range of present accounts you can choose among, though it doesn’t offer any premium account options for high-end customers. Where there is not a association, your bank or building society only has to provide a immediate and efficient service that will help you close your account and it must return any money because of you. A bank or building society can refuse to open an account for you. They haven’t got to give you a reason, and there is usually nothing you are able to do about it. If you are on this category you additionally can’t be added to someone else’s account as a joint account holder or be a signatory or beneficiary in relation to any account.

It’s a free service, all you need to do is pick the date. FlexAccount – Our on an everyday basis current account where you can bank your way with no monthly fee. When you open a present account with us, it’s not like opening one with any old bank. Living overseas can affect your current account’s insurance benefits. Our purpose-led business strives to put the wants of individuals and planet at the heart of everything we do. To do this, we’re building a bank that is safe, simple and smart.